How Swing Trading Works

Swing trading is deceptively simple – you earn profits by going with the trends in the market. To do this, you study a given financial security and look for support and resistance. Support is the low pricing point below which the asset has not crossed. Resistance is the high pricing point, above which a break is not possible. Of course support and resistance are temporary pricing levels, and they are apt to change at any time. On the stock market, a bad earnings report can lead a stock to drop below its previous levels of support. On the other hand, a good earnings report or the release of a new product can cause prices to skyrocket. Part of your job as a swing trader is to keep up with the markets and market news, so you know when such opportunities might present themselves. We will talk about support and resistance in more detail later, when we discuss chart analysis.

Of course prices are moving up and down all the time, so you aren’t always waiting for big news to break. There are opportunities to get in on trades all the time – if you know what to look for. Prices will move “sideways” for long time periods, before making a break to the upside or downside. Alternatively they can be “boxed in” between support and resistance. Even then there are opportunities to earn profits, although they won’t be as large as when there are big movements. We will be teaching you what to look for later in the book.

How to Make Profits from Swing Trading

To understand how you can profit from swing trading, it can be helpful to look at a couple of mock up charts. First let’s take a look at the general idea. Asset prices fluctuate down all the time, and on different time scales. In its simplest form swing trading takes advantages in the swings up and down on the markets – you buy low and sell high.

Of course any investor can say they hope to buy low and sell high. The swing trader hopes to capitalize on a swing, or a single move in the asset price. Swing traders hope to earn profits from breakouts, when the asset price increases to a new level. Alternatively, you can short the asset if its experiencing a major decline. Swing traders can also earn smaller profits as the asset price bounces higher and lower about the median.

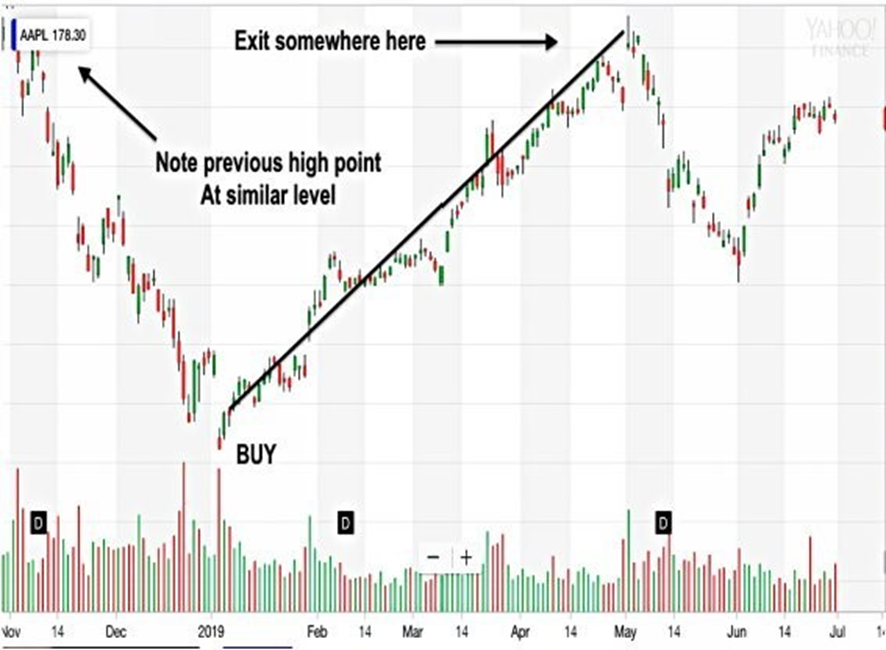

This graphic indicates price levels of support and resistance for some financial asset. Our goal in this chart is to look for an opportunity to buy the asset when the price is low, and then sell it when the price rises. There are many techniques a trader will use to estimate the right times to enter a position.

The dashed line at the bottom of the chart represents support. This is a price level that historical data have shown that as the price of the asset decreases, it will stop and reverse and enter into an increasing trend after it reaches the support point. So an asset that is trading at the support pricing level is one that a trader wants to invest in – if there are signals of an uptrend. There are other opportunities to get in on a trade as well at higher pricing levels. A trader will enter a position if there are signals that the asset price will continue increasing to the resistance level.

So, we say that a swing trader will buy at support. This is if you expect the asset price to increase. If you expect it to decrease, then you sell at resistance.

To make a profit, the trader needs to know when to exit a trade. The resistance level provides the best opportunity to do so. Profiting from your trades can take discipline, there is always a chance that the asset will break above the resistance level, and emotions make people anxious to take advantage of such situations. But waiting to long to exit a position can be costly, if the price drops rapidly back to the support level. It’s important to understand that swing trading is not gambling. The trader uses technical analysis to determine the best prices at which to buy and sell, in order to profit from the trade. But the concept is pretty simple for increasing prices – identify levels of support and resistance and buy low when pricing is at or near the support level, and there are indications of an upward trend. Then you sell high at a pricing point that you determine to make profits, and exit the trade.

As you’ll see later in the book, the many tools of technical analysis can give you a solid indication of coming price trends, and the mood of the markets. But it’s important to be realistic and recognize that no tool is foolproof, and you can’t win on every trade. The bottom line is the indicators aren’t right 100% of the time.

Swing traders can also earn profits from declining asset prices. For example, you can short stocks or purchase put options. If you don’t understand how that works now, don’t worry, we will discuss that in the coming pages.

For now, let’s just understand the overall picture. This time you enter your position when the asset price is relatively high, and all the signals are pointing to a coming downward trend. Then when the price drops to a profitable level, you exit the position. Graphically it looks like this.

This is the central idea behind swing trading. Of course in practice, its not that simple otherwise everyone would be doing it and raking in millions of dollars. Becoming a successful and profitable swing trader requires mastering the tools of technical, chart, and fundamental analysis so that you know when to enter and exit positions, and whether to go long or short your positions. We will be discussing all of those tools in the book. For now, let’s take a step back and take a look at the three biggest markets where swing trading is used.

Swing Trading with Forex

Forex is the foreign exchange market where the various currencies of the world are traded against one another. Forex isn’t just in the United States, there are trading markets around the globe, so it’s a huge market, with $5 trillion traded daily – compared to $200 billion on the stock market. The largest markets are in New York, London, Tokyo, and Singapore. Currencies around the world are traded in pairs, so you could trade the dollar against the Great British Pound, or the Dollar against the Yen, or the Euro against the Pound, for example. While all currencies in the world are traded, the focus is mostly on currencies used in the largest economies, including the Euro, the British Pound, the US Dollar, and the Japanese Yen.

Unlike the stock market, which goes through brokerages that charge high commissions, Forex is traded over the counter with small or no commissions. Since there are markets worldwide, it’s open 24 hours a day, 5-days a week. It’s also highly liquid. That means there is enough volume in trading activity to enter and exit positions quickly, making it well suited for swing trading. During any business day of the week, traders can open and close positions 24 hours a day. It’s also possible for traders to utilize a great deal of leverage on the Forex markets as well.

Swing trading on Forex doesn’t require a huge time commitment. You can check your charts a couple of times a day, so its suitable for someone with other things going on in their life like a job, that makes it hard for them to sit at the computer all day long.

Several swing trading methods are used on the Forex markets, including those we will discuss in the book, including candlestick trading, trend trading, range trading, mean reversion trading, chart analysis, and Bollinger band trading. There are also several more that we will discuss in later chapters.

Swing Trading with Options

Options are a type of derivative that allows you to control shares of stock without actually owning them. There are two types of options, calls and puts. Calls give the buyer of the option the right to buy the underlying shares of stock at a price called the strike price. That price is fixed in the contract, and so at any given time may be well above or below the market price for current trading. Since it may allow holders of the options contract to obtain the underlying shares of stock at a reduced price, options contracts can be valuable. However, they come with an expiration date, which means they are also becoming less valuable as time passes. You can think of it as an old style hour glass, with the sand in the upper part of the hour glass representing the time value of the option. As it drains into the bottom part of the glass, the option is losing value, and eventually the time value all drains away. However, if the strike price is lower than the market price, the option still has value and can even be exercised, which means that the buyer of the option can elect to actually buy the shares. Because of that intrinsic value, call options gain value with rising stock price.

Options also make it easy to profit from downturns in stock price. In this case, you would purchase a put option, which gives the buyer the option to sell a stock to the writer. Put options also have a strike price, and they become valuable when the strike price is higher than the market price of the stock. What this means is that the buyer of the option could then purchase low prices shares on the market, and then exercise the option by selling the shares to the writer of the contract. The more the stock drops in price, the higher the value of the put option. Of course put options also come with an expiration date, so the decreasing time value also impacts the pricing of put options.

Options are inherently short term assets, making them ideal for swing trading. The shortest term for an option is one week, so the option will expire a week after its issued. Most options are monthly, but there are longer term options that can expire up to one or two years from the current date. Those are called LEAPS, which means Long term Equity Anticipation Security.

Options can be purchased on many securities, as well as on indexes. They represent a great opportunity for swing traders because they don’t require much capital to invest up front, and there are also strategies that can be used to limit risk. For swing traders, the same tools and analysis that would be used with stocks are used with options, since the value of the option is directly related to the changing price of the underlying stock. However the swing trader of options needs to be paying attention to the expiration dates of any options in their portfolio.

Swing traders who trade options will primarily use the techniques that swing traders of stocks will use.

Swing Trading Stocks

Swing trading stocks is very popular, since there are many highly volatile stocks and stocks tend to breakout to the upside or downside quite often. While the stock market is less liquid than Forex, because of the way the markets behave, stocks can be more amenable to many swing trading strategies. A swing trader on the stock market can profit from price appreciation by going long, and can also short their positions when appropriate.

Swing traders on the stock market will utilize all the strategies of swing trading. This will include trading with the trend, looking for breakouts, Bollinger band trading, chart pattern analysis, candlestick trading, and more. As we’ll see in the next chapter, swing trading has some similarities to other styles of trading and investing, but there are also many differences. Swing trading is not something that a Warren Buffett style investor would be interested in.