In this chapter, we will compare and contrast swing trading with some of the main strategies that other traders and investors use. First we’ll look at day trading, and then we will compare swing trading with position trading and buy and hold investing. Then we’ll talk about buying long and selling short.

Swing Trading or Day Trading

One of the ways that traders are divided is by the time frame over which they enter and exit trades. This is the main differentiating factor between day traders and swing traders, and that has a lot of implications. First lets start from the basic approach used by both methods of trading. Both seek to earn profits from price moves of a financial asset. Swing traders enter their positions and keep them for any time frame ranging from days to weeks, even out to a couple of months.

In contrast, day traders seek to enter and exit their positions within one trading day. In fact a day trader can take multiple trading positions on the same day, but will be out of all of them by market close. While swing traders hold positions overnight, a day trader always exits their positions. This is necessary because day trading involves minute by minute monitoring of their positions, and they enter trades and exit them on time spans of hours. If a day trader were to hold positions overnight, it’s possible that they would lose all the money in their positions from activity over the span of minutes at market open.

Being a day trader requires an intensive time commitment. The trader must keep a close eye on the markets and their positions as long as they’re active. They seek highly volatile stocks, often trading small-cap and even micro-cap stocks, looking to profit on what to others is the noise in the stock market. Company fundamentals play a minor role, if at all, in the analysis of the day trader. In most cases, day traders are looking to earn profits from price fluctuations that result from big players buying and selling shares. Fundamentally, day trading comes down to profiting off the fluctuating supply and demand of shares. Commissions from the brokerage can be a huge expense for day traders, since they may have to execute a large number of trades each day.

Swing traders can invest in companies of any size, including large-cap blue chip companies. Swing traders can also trade index funds, which is probably not something a day trader would be looking at.

As we’ve stated, swing trading involves positions that can be held days, weeks, or months. This has important ramifications when compared to day trading. Over these extended time periods, company fundamentals can become important. Earnings reports, product releases, changes in management, or just changes in the economy at large can impact asset prices on these time scales. That means a swing trader needs to be paying attention to company fundamentals.

In most cases, swing trading can generate larger profits, per trade. That’s just a fact that comes from how things operate when you hold your positions longer. There can be exceptions, but that is the general rule. Furthermore since swing traders are entering fewer trades, they are going to be facing lower levels of expenses arising from commissions and fees.

Despite these differences, day traders and swing traders rely on many of the same tools. These include analysis of chart patterns, trend lines, Bollinger bands, and candlesticks, among many others. But, they are using these tools over different time frames. For a swing trader, the short term fluctuations of a stock within an hour are probably not attract the same level of interest as compared to a day trader.

The two trading styles don’t just differ in technical details like the length that a trading position is held. Swing trading and day trading have different capital requirements, time commitments, and even different mindsets, even though there will be some overlap.

Although you can make an absolute distinction on paper, it’s not always an “either-or” dichotomy. Some traders are exclusively one or the other, but it’s also possible to engage in day trading and swing trading at the same time. That is not an approach that is recommended for most people, and splitting your attention like that would probably inhibit your odds for success.

But let’s take a closer look at some of the differences. The first difference that immediately stands out are capital requirements on the stock market. Day trading is a closely watched activity by brokerages and federal regulators, because it’s believed to be very high risk. In fact, to open a day trading account in the United States you need to have a minimum of $25,000 in the account.

According to the United States government, you are a “pattern” day trader if you engage in four day trades within any five day period. Weekends don’t count, only business days. To be a day trade, you have to buy and sell the same security on the same day.

All trading is risky, but compared to day trading swing trading carries far less risk. The short term minute-by-minute fluctuations that can wipe out the account of a day trader aren’t nearly as relevant to swing trading. One consequence of this is that swing traders have a lot of flexibility when it comes to the amount of time that you are going to devote to trading. While its possible to be a full-time swing trader, many swing traders only do it on a part-time basis. The fact that they are looking to profit on longerterm price movements means that it’s even possible to submit trades after hours.

Another consequence of the lower overall risk of swing trading is that there are no capital requirements. Financial advisors might have recommendations, but you can open an account of any size and begin swing trading.

Day trading is something that requires intense focus, and it’s also a high stress lifestyle. While swing trading can certainly bring stress if positions aren’t moving in the right direction, the longer time frame means that sustained attention to the stock market all day long isn’t required. The overall stress level is also quite a bit lower. Day trading attracts actionoriented “type A” personalities. In contrast, since you are holding positions for longer periods that can require waiting for the right time to make a move, swing trading actually requires patience.

Since Forex is over the counter and lightly regulated, it has lower capital requirements for day traders. You can day trade on Forex with as little as $500. There are not official requirements for swing trading on Forex, but its recommended that you open an account with at least $1,500.

Swing Trading vs. Buy and Hold Investing

Buy and hold investing is a long-term strategy that seeks to preserve wealth and grow it over time. A buy and hold investor is not interested in short-term market fluctuations, generally speaking. At the most, a buy and hold investor will look to purchase stocks when they are undervalued, so they may take advantage of a drop in price. They never short the market, and instead hope to profit over years and even decades from the overall rise in the stock market as the economy grows.

The techniques used by long-term investors are very different from those used by swing traders and day traders. Ups and downs of market prices are largely ignored, and they utilize a strategy called dollar cost averaging to purchase shares at regular intervals, regardless of the price. Over time the highs and lows average out as overall, there is asset appreciation.

The second major strategy that buy and hold investors use is diversification. They want to invest in a large number of stocks so that while individual stocks might have ups and downs, the overall portfolio tracks the market. They are satisfied matching market returns. In fact, many buy and hold investors take this to the extreme, investing only in index funds that track major indices such as the S & P 500. These types of investors don’t even do much fundamental analysis, and it’s a strategy that requires little day-to-day attention.

As you can see, there are many differences between long-term investors and swing traders. While the long-term investor is attempting to build up a diversified portfolio over years and decades, a swing trader may be focused on one or two stocks, and exit the positions in a matter of days. While buy and hold investors are satisfied tracking overall market performance, swing traders seek to beat overall market performance. Swing traders utilize the tools of technical analysis in order to find the right entry and exit points of their trades. Long-term investors ignore them and don’t care about short term fluctuations or swings.

Swing trading or Position trading

Position traders seek to hold an asset for a long period of time, but they are not buy and hold investors. They are traders who seek to earn profit from their trades, rather than holding assets in order to build wealth. Position traders on the stock market can hold positions for several weeks, months, or even years.

Position trading on the stock market can be viewed as a long-term version of swing trading. They will rely on both fundamental and technical analysis. Since position traders will on average hold assets for a longer time period than a swing trader, fundamental analysis plays a larger role in their decision making. Capital is more liquid for swing traders, since they are entering and exiting trades more often. Position traders will have their capital locked up in an asset. This can last for potentially long periods. Since they are holding long-term positions, position traders are more sensitive to economic trends and the overall state of the stock market.

Position trading is not an active form of trading. They are hoping the long-term appreciation of the asset will lead to profits. Day traders may do hundreds of trades per year, but position traders enter into about 10-12 trades per year on average. Swing traders are more concerned with short term fluctuations in asset price than position traders, although position traders need to be alert to trend reversals that could cause losses.

There are many similarities between swing trading and position trading. They both rely on fundamental and technical analysis, and compared to day traders hold their positions longer. They are both trend followers who seek the right entry and exit points for their trades. Overall, it’s simply a matter of trading frequency.

While options are a perfect fit for swing traders, position traders won’t trade weekly or monthly options. However, you can use LEAPS for position trading, since you can hold them for long time periods, even up to two years.

Position trading is also a popular Forex strategy. Fundamental analysis plays an important role in Forex position trading, even including macroeconomic factors like changes in GDP. They will use technical analysis to determine entry and exit points for trades. Position traders also have a wider stop loss, which may require more up front capital. However, position trading on Forex tends to have a favorable risk-to-reward ratio.

Market Participant

Market participants include many people and organizations. Most fundamentally, market participants include the buyers and sellers on a given market who transact to transfer assets. A market participant must be capable of entering the transaction. Other market participants can include:

Broker Dealers who handle trades between buyers and sellers, and may use their own inventory to facilitate transactions.

Clearing Agencies, who clear and settle trades.

Electronic communications networks that automatically match buyers and sellers at specific prices.

Investment advisors that provide advisement for a fee and/or issue publicans on investment recommendations. They can be companies or individuals.

Securities Exchanges are the markets where securities are bought and sold. Stock markets in the United States include the New York Stock Exchange and NASDAQ. Options are traded on the Chicago Board Options Exchange.

Transfer Agents maintain records related to securities and record changes in ownership.

High frequency trades

High frequency trading is computer-based algorithmic trading. It utilizes computer software to perform multiple trades per second. There is little human input to high frequency trading. Since multiple trades are executed per second, this can lead to large moves on the market that can seem mysterious to live, active human traders. High frequency trading has been encouraged because it generally increases liquidity on the markets. However, critics complain that high frequency trading puts small retail investors (that means individual investors) at a disadvantage.

How to start trading

The first step is to sit down and do an analysis of your own situation. Begin by deciding what your goals are and the level of commitment you are able to devote to swing trading. This includes the amount of financial capital that you have available to invest, as well as the amount of time you are able to devote to swing trading. This can change down the road, but you should map out your first three months. At a minimum, you are going to need a working computer and a solid internet connection. It can also be helpful to have a smart phone, because many brokerages have apps that can be used as an additional tool. Mobile apps can help you monitor the markets, make trades, and receive alerts. You may also want a printer to print out charts that you can analyze by hand, but many investors just study them on the computer.

Once you have all of your equipment nailed down, the next step is to select a broker. The stock brokers of yore have been replaced by online websites and mobile apps. Each broker has their own advantages and disadvantages. Some of the factors that you will want to consider are:

Commissions charged per trade. High commissions can eat people alive when they are doing a large volume of trading. For swing traders, this isn’t as much of an issue as it is for day traders, but it could still be important. These days there are many options available providing a wide array of pricing and features. Keep in mind that the brokerages with the highest commissions don’t always have the best features.

Minimum deposit. If you are hoping to start small, you might want a broker that doesn’t require a large minimum deposit. The requirements vary, and some don’t require any minimum deposit.

Simulated trading. Many brokerages offer trade simulations that help new traders hone their skills. Going through the process

can help you get a feel for swing trading and you can see what the results would have been, without using real money.

Trading platforms. In today’s world, a broker with multiple trading platforms is essential. You will want a broker that also offers a mobile app.

Ease of use. This one is hard to evaluate without experience. You might want to sign up with more than one broker if it’s possible, so that you can directly test their platform. If that isn’t something that is feasible, you can read online reviews.

The ability to trade options. Even if you don’t go in right away trading options, you will want to have that feature available in case you decide to try it down the road.

Analytical tools. You will want strong analytical tools for your charting as well as for determining potential profits.

In our experience, newer brokerages are better options. Tasty-works and Robinhood are good options, with the latter being an excellent choice for beginners. The main argument against Robinhood is the skeletal set of features. But you can make up for that by utilizing charting on other free platforms like Yahoo Finance. However, Robinhood is very simple to use in order to execute trades.

The science of buying long

Buying long means entering trade when a swing is at a low point or point of support. That is, you are expecting the asset to appreciate in value, so you will buy at what you think is a low price, hoping to profit on coming gains in a swing.

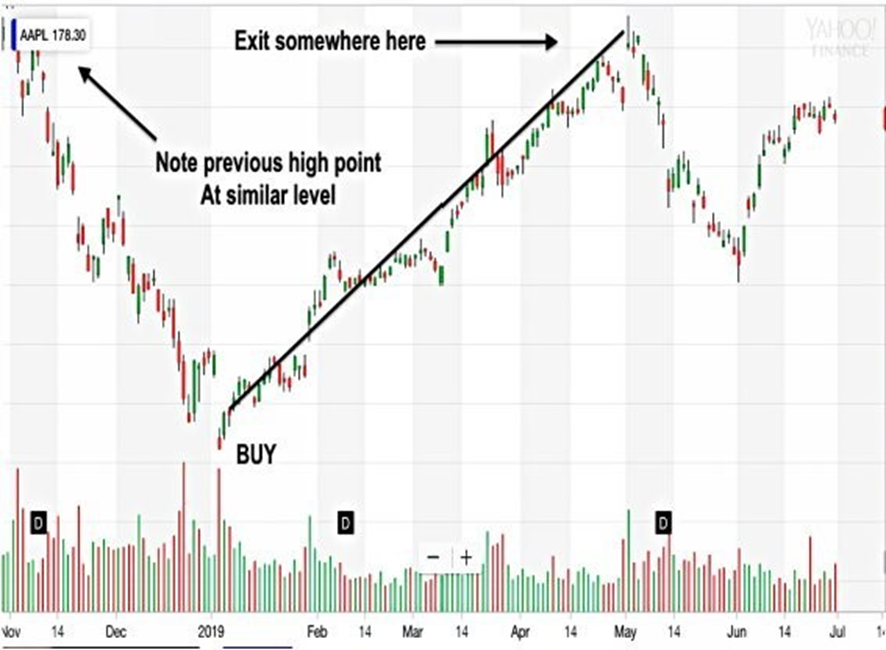

Knowing the best times to enter a trade depends on many factors studied in technical analysis, and we will discuss them in detail later. For now, we only seek a qualitative understanding of the science of buying long. In Swing trading you are hoping for an upward trend in price that can last anywhere from a day to several months. You enter the trade at a low point, and then exit within one swing. Entering a trade means buying the stock in this case, and exiting the trade means selling the shares and taking your profits.In the example below, we see Apple provided an opportunity to win with a swing trade over the course of a couple of months. Notice that the previous highs would provide a guideline for the pricing level when you should sell your shares. The range to enter the trade was actually fairly obvious, because the share price had been much higher recently. If that was a level of resistance you can use that to execute a limit order, which means that your shares will automatically sell if the market price meets or exceeds the price specified in your limit order.

The chart indicates that after falling to a possible low, Apple may have established a new level of support, as seen on the right side of the chart.

The science of selling short

Selling short can be a new concept to many investors. If you are like most people, you’ve only thought about the stock market in terms of buying long. And chances are you’ve been thinking of it in terms of long-term investing over years and decades.

Selling short can be an entirely different ballgame for many people. While the stock market appreciates in value over the long term that tends to average out prices, in the short term stocks can fall quite a bit. The market provides ways that you can profit from these declines. There are two ways to do it, you can short (sell) the stock, or you can invest in put options. Either way, you would do this when you see the stock entering a downward trend.

In order to short the stock, first you borrow the shares from the broker. Then you immediately sell them to get cash in your account. After this, you simply wait for the share price to drop. If it drops significantly, then you can buy the shares back at a lower price. Remember you borrowed the shares from the broker, so you can simply return the shares. Your profit is the difference in prices.

For example, suppose a given stock was trading at $50 a share. If a major decline was expected, you could borrow the shares, and then sell them on the market. Later, the decline materializes. Let’s say the share price dropped to $20 a share. You can buy them back at this discounted price, and then immediately return them to the broker. Your net profit would be $30 a share, ignoring commissions.

Put options offer another, fairly straightforward way to bet against a stock. If the price of the stock goes below the strike price of the put option, then the put option will gain intrinsic value. Remember that options have an expiration date as well. What you want with a put option is for the share price to drop below the strike price. That makes the put option far more valuable. If that happens, a trader can exercise the option and use the same strategy described above.

Suppose that once again, we are interested a stock trading at $50 share. We buy a put option with a $50 strike price. Then the stock tumbles as expected. We then buy the shares on the market for $20 a share. Then we exercise the option, which in the case of a put means that we sell the shares to the writer of the contract at the strike price. So once again we earn $30 in revenue from the decline in share prices. When discussing options, you have to figure the option price as well as commission in your expenses.