Ingredients: Dry Ingredients: Wet Ingredients: For frying: Optional toppings: Instructions: 1. Activate the yeast: 2. Mix the dry ingredients: 3. …

Ingredients: Dry Ingredients: Wet Ingredients: For frying: Optional toppings: Instructions: 1. Activate the yeast: 2. Mix the dry ingredients: 3. …

Ingredients: For the meatballs: For the gravy (sauce): Instructions: 1. Prepare the meatballs: 2. Make the gravy: 3. Add the …

Ingredients: Equipment Needed: Prep and Cook Time: Instructions: 1. Prepare your oven and pan: 2. Beat the eggs and sugar: …

OMG DON’T LOSE THIS RECIPE! This Herb-Roasted Easter Lamb is a tender, flavorful roast infused with fresh herbs and garlic, …

Ingredients: For the egg salad: For assembling: Instructions: 1. Boil the eggs: 2. Peel and chop: 3. Make the egg …

Ingredients: Dry Ingredients: Wet Ingredients: For frying: Optional toppings: Instructions: 1. Prepare the dough: If using baking powder (quick donuts): …

Ingredients: For the dough: For the filling: For the coating: Instructions: 1. Make the filling: 2. Make the dough: 3. …

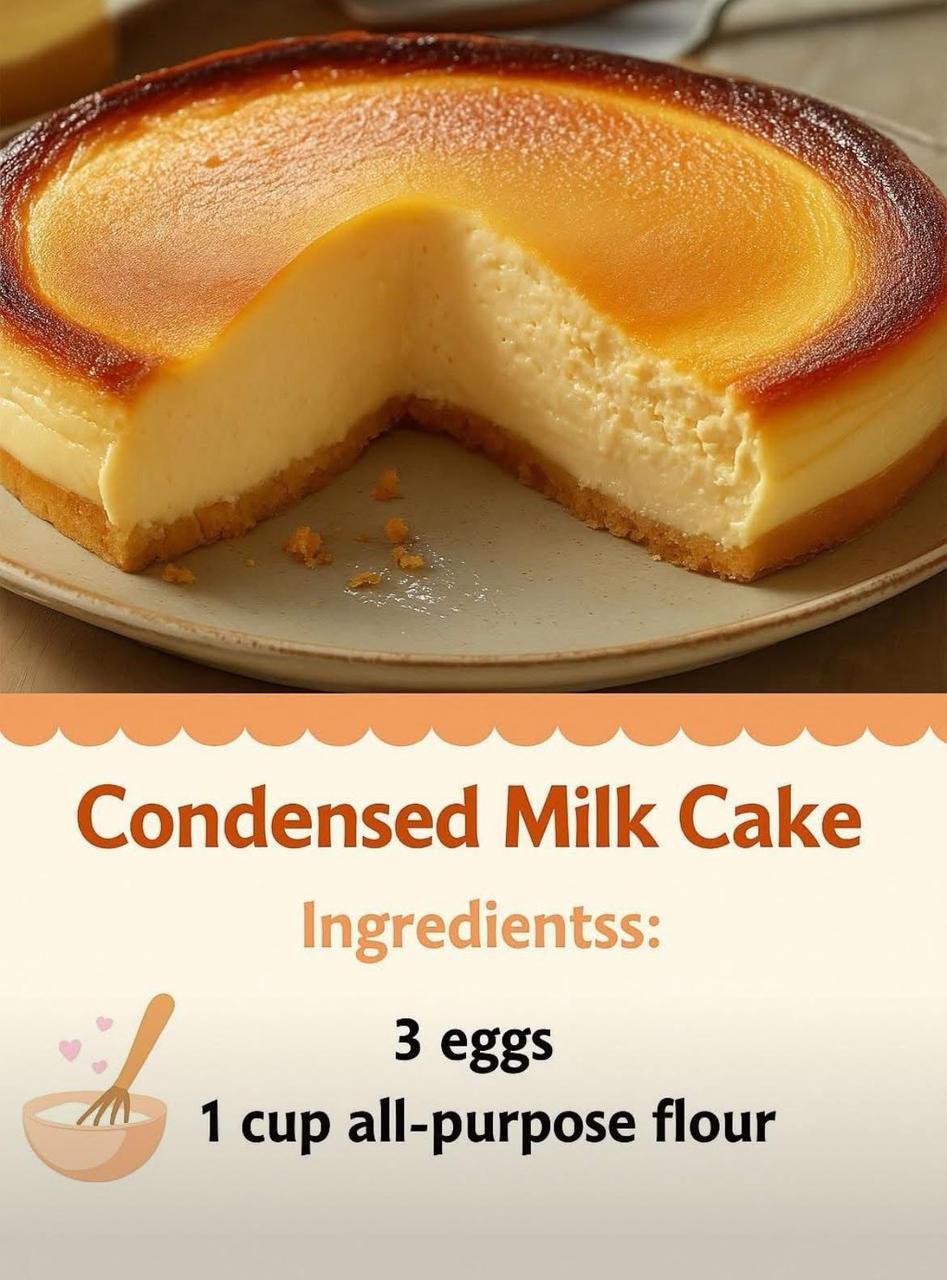

Ingredients: Instructions: Enjoy your delicious, sweet Condensed Milk Cake!

Ingredients: Instructions: 1. Activate the Yeast (Optional if using instant yeast) If you want extra fluffiness (optional step): 2. Mix …

Craving a tender, flavorful beef brisket without the hassle of constant attention? This Slow Cooker Beef Brisket recipe is your …