Fundamental analysis is a process by which you study the fundamentals behind a financial asset. On the Forex markets, you will be looking at the state of the economy, GDP growth, and political factors that impact the overall picture and stability of the country. If these items are looking good, that means the currency for that country will gain strength. But since currencies are traded in pairs on Forex, that means you also have to compare fundamentals between countries. If Europe looks strong but Japan is looking even better, then the Japanese Yen would strengthen as compared to the Euro.

When it comes to stocks and options, the fundamentals include profit margins, price to earnings ratios, cash flow and other indicators that give a picture of the overall health and prospects of the company. You’ll be wanting to take a look at quarterly earnings, and reviewing earnings calls for companies that you are invested in. Fundamental analysis also means looking for stocks that are currently undervalued. The price of undervalued stocks is likely to increase at some point in the future, so spotting an undervalued stock could be useful for the swing trader.

Since swing traders have different time horizons as compared to buy and hold investors, short-term results like earnings calls are going to take on a larger role, as compared to looking at trends in revenue and profits over the course of years. A good earnings call can send prices soaring, while failing to meet expectations can send stocks into a rapid decline. When there are events like this as a swing trader you have to be ready to seize upon them as quickly as possible.

It’s also important to keep your eye on company news of a more general nature. If a product fails or ends up creating legal trouble for a company, that can be an opportunity to short the stock or invest in put options. Alternatively, the release of a new product that exceeds expectations can be an opportunity to go long on the stock.

Financial Reports to Read and Where to Get The Information

The SEC requires that all publicly traded companies make audited financial statements available. This includes a prospectus and an important report filed annually which is called the 10K. In these documents you’ll find audited records that include items such as cash flow, balance sheets, and other financial data. They also include important information about the management team and competition the company is facing in its sector. The company must also give shareholders an overview of its future plans and information about attempts to enter new markets. You can visit company websites to get these reports, or do an online search using the company name with “10K” or “prospectus”. Summaries of financial information are also available on many stock websites free of charge. For example, you can get income statements, balance sheets and cash flow on Yahoo Finance for any company that is listed on the stock exchanges.

There is also another important report that may be released from time to time, called an 8K. These contain information similar to that found in a 10K, but they are only filed when important short term information has to be disclosed to investors. At times, the information contained in an 8K can have a major impact on share price.

Financial Statements in More Detail

There are three general types of financial statements, in case you aren’t fully aware. These include the following:

Income statement: An income statement will include information such as revenue, gross profit, and operating expenses. These reports can help you determine the overall health of the company, and you can look for trends in revenues and profits over the past few years. Be sure to look for net income as a percentage of revenue. As a swing trader, while you are going to want to have an understanding of the overall health of the company, you are going to be more interested in looking at quarterly statements and keeping up with earnings calls and other announcements.

Balance sheet: A balance sheet shows current assets and liabilities for the company. Current liabilities are of particular note on a balance sheet. You want to look at a balance sheet thinking about

the financial health of the company. Is it carrying a large amount of debt? Is the amount of debt increasing, and could that prevent the company from being profitable or paying dividends at current levels? These factors may make a company less appealing to investors. When a company is younger and in an aggressive growth phase, investors may be more tolerant.

Cash Flow: Cash flow is a summary of items such as net income, changes to inventory, depreciation, changes to liabilities and financing opportunities among others. Cash flow can give you a good overview of recent company performance and is another way to gauge the health of the company. Pay special attention to changes in inventory. Ask yourself if it looks like the company is able to move its product.

When examining quarterly data, you’ll want to compare quarterly results to the same quarter a year earlier. In many cases, company performance will depend on time of year, so the best way to see trends in the company’s performance is to make an apples to apples comparison, rather than just looking at how revenue and net income changed from last quarter to the most recent quarter.

Earnings Calls

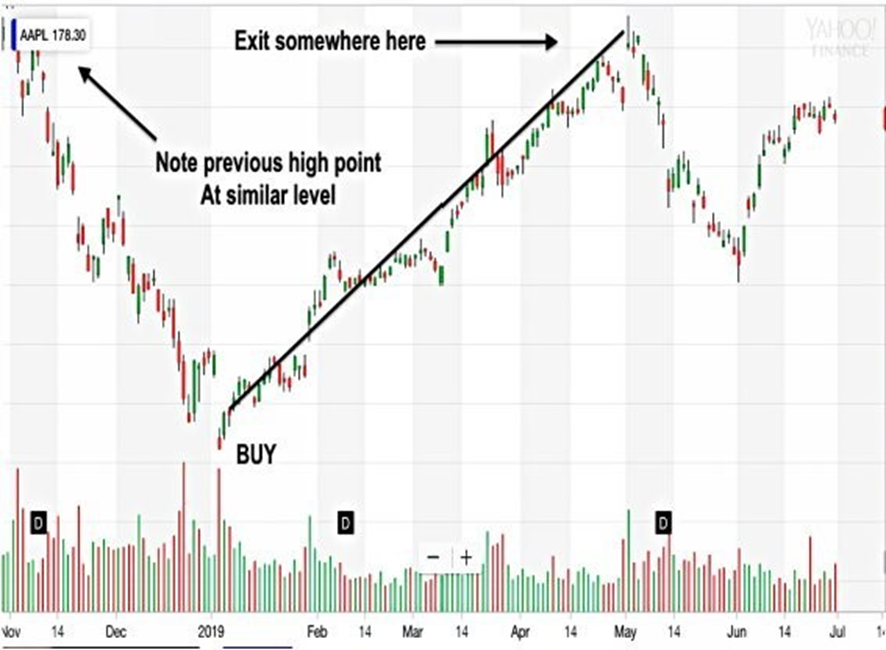

On a quarterly basis, one of the most important events for a swing trader is the earnings call of the companies that the trader is interested in. Earnings calls can lead to dramatic swings in stock price, depending on whether it’s a good earnings call or a bad earnings call. In the crazy world of Wall Street, an earnings call largely depends on what people are expecting out of it, rather than any absolute measure of performance. For example, if investors expect earnings to increase 25%, and the company reports that it only grew earnings by 10%, even though any rational person would view that as a positive, Wall Street is probably going to react negatively. Of course, if the report shows a decline it’s going to be that much worse. The thing about this for the swing trader is we don’t know how strongly the market will react. If share price is $200, it might drop to $180, or it might drop to $170. Nobody knows ahead of time, but you should be ready to enter into your trades accordingly.

Things work just as well the other way around. If analysts were expecting a company to see a 10% increase, but they report an 18% or 25% increase in year over year profits instead, this will send the stock soaring. Again, nobody is sure how high it will go. You will have to have a preset value of profit you are willing to accept on a trade, and place a limit order ahead of time. Then you have to live with the results. If your limit order is at $220 a share, you can be happy with your $20 a share gain, even if the stock keeps rising. A disciplined trader that doesn’t get greedy is far more likely to succeed over the long-term.

While it’s impossible to know ahead of time how an earnings call is going to go, you can gain some familiarity with a company and how the market reacts to it by going over previous earnings calls. Do so by not only reviewing the content of the calls, but by looking to see how strongly the market reacted to them.

Keep in mind that a bad earnings report isn’t just an opportunity to short stock or invest in put options. When the stock drops, it’s also an opportunity to get in at relatively low price point. Don’t set perfection as a goal for your trades. The only thing you should worry about is getting in on the stock when prices are relatively low as compared to the previous price level. If it continues going lower, beating yourself up over missing the opportunity is a waste of energy. Instead, focus on waiting – for the stock to go back up so you can profit at a future date.

If the earnings report turns out to be a good one, you might want to be ready to enter into your position immediately. Then you can ride the wave of rising share prices. It’s not necessary to invest before an earnings call and it could even be a bad decision to do so, because you won’t know for sure which way things are going to go. In any case, earnings reports are an important part of your fundamental analysis to see how the company is performing.

Price to earnings ratio

An important metric that matches share price and earnings per share is the price to earnings ratio. Investors and traders are on the look out for price to earnings ratios that are excessively high, and also for price to earnings ratios that are low in comparison to similar companies in the same sector. If the price to earnings ratio is excessive when compared to other companies in the same sector, that could mean the stock is overvalued, and might head into a downturn at some point. Conversely, an undervalued stock as indicated by a relatively low price to earnings ratio is a stock that is available at a “discount”, because it’s undervalued. At some point – the thinking goes – the stock is going to rise in price up to it’s true value.

You shouldn’t just take the price to earnings ratio at face value. If you notice one that is out of line with the rest of the industry, you should do some research to find out if there is some external reason behind the difference. That may require a detailed check of news about the company on financial websites, as well as reading press releases and 8K reports issued by the company.

An interesting and recent example is Ford Motor Company. At nearly 14, the price to earnings ratio of Ford is nearly twice that of other auto companies. Compared to GM, it’s actually more than twice as big. At the time of writing, it alone stands out in the automobile sector, where all the other companies are in a similar range. It’s extremely unlikely that Ford represents the standard of the sector and all the rest of the companies are undervalued.

That could mean one of two things – Ford is in for a correction at some point in the future, or Ford has recently made some moves or announcements that make it deserve the high ratio. The first step you should take is to look over financial reports and compare profit margins between the different auto companies. You’ll also want to look for any news you can find about Ford in recent months.

It could be something as simple as a stock split. When a company splits its shares, the amount of money invested in the company stays the same but the number of shares changes. Splits can work in both directions. Companies can use splits to inflate or deflate price to earnings or earnings per share ratios.

In general, if the price to earnings ratio appears excessively high or low, this can indicate that the stock is in for a correction in the coming months. If it’s excessively high this is an overvalued stock, and the price of the stock might be set to drop in the coming weeks. We would expect it to drop until it reaches a more appropriate level for its sector. On the other hand if its low and the company fundamentals look good, that can be a sign that the company is poised for gains. So the price to earnings ratio can indicate that an individual stock is set to undergo a “correction”.

But keep in mind that there is no “right” or “wrong” price to earnings ratio. As we explained above, you will have to look at companies in the same sector to get an idea of how a given company compares to it’s competitors. Obviously you don’t want to compare a bank to an auto company or to a social media company. Also make sure you are really comparing the same measurement. A good one to look at is TTM. This means trailing twelve months. You will also see past-looking and forwardlooking price to earnings ratios. I prefer to avoid forward looking and stick to the TTM value. To get a feel of how different they are from sector to sector, since we’ve already looked at automobile companies, let’s compare that to some other industries.

Let’s look at a younger and growing sector, social media companies. Looking at Twitter, we find that the P/E (TTM) ratio is 20.61. This is actually considered a pretty average price to earnings ratio. Looking at Facebook, the price to earnings ratio is a bit higher, checking in at 28.58. That’s almost 42% higher than Twitter, but given the more successful financials that Facebook has, it’s probably justified.

Now let’s look at a newer company, such as SNAP. In this case, there isn’t any price to earnings ratio given. That means SNAP is not profitable. Since it’s a young and growing company, that’s not really relevant, at least not yet. Investors are going to want to see results at some point – but for now they are relatively patient. Tesla is another example of a relatively young company that is poised for rapid growth – it has yet to have positive earnings.

Searching for some more social media companies, we find one that is way out of whack. YELP is sometimes considered a social media company, and its P/E ratio is 49.89. This is much higher than what we’ve seen so far. YELP is a popular website to be sure, but it doesn’t seem to have any fundamentals to justify a price to earnings ratio that high. That could mean it’s in for a price correction in the coming months.

We can also find examples on the other extreme. Weibo corporation has a P/E ratio of 15, which is comparably low.

You can also look at closely related companies that are similar, but not necessarily in the same exact sector. Microsoft is a technology company and they own Linked-In, so that seems like a good candidate. Their P/E ratio is 30 – about the same as Facebook.

With these values in mind, Weibo might be a hidden opportunity. Before deciding, however, you’d want to look at the company financials and read what analysts are saying about it. Something a swing trader should always keep in mind is that looking at a single metric should not drive your decision making. You need to find confirmation elsewhere.

The point of looking at price to earnings ratio is that it’s a starting point for further research.

Social media is a new and growing sector. It’s interesting to look at another more slowly moving sector such as banking. Here is what we find:

Wells Fargo: 10.24

Bank of America: 10.4

Citigroup: 9.81

JP Morgan Chase: 11.72

Notice how they are all clustered around the same value. If you are looking at stocks in the banking sector, any stock that had a price to earnings ratio that fell outside of the range 9-11 would be very suspect, possibly representing an opportunity to look at for a future price swing. Open Interest, Volume, Short interest and Put to Call Ratios

Looking at options, open interest, volume and short interest are some of the factors to consider. These can also help you determine where traders expect prices to go. There aren’t absolute numbers that can be used as a guideline, everything is relative.

Open interest tells you the number of options contracts for a given strike price and expiration date. Options traders seek out a minimum of 100, because this indicates enough liquidity that you can quickly get out of a trade. When you find strike prices with higher levels of open interest, these are probably price levels where expert traders are expecting the stock to go in the near future. You will want to compare open interest numbers for calls and puts on the stock. Calls are bets that the stock is going to rise in price, while puts are bets that the stock is going to decline in price.

Volume tells you the number of trades that happened on the most recent trading day. This also gives you an indication of the level of interest in the strike price – where people thing the stock price may be heading.

You can also take a look at short interest, and also the put to call ratio for options related to a stock. Short interest tells you how many investors are shorting the stock. If this number is high, that indicates that the investing community is expecting a stock price to decline in the near future.

This information is also communicated by the put to call ratio for options related to the stock. Investors who think that a stock price is going to decline are going to invest in put options. If the put to call ratio is excessive, then that can reflect an expectation of coming price declines in the stock. You can compare the value you find for a given company to similar companies in the same sector. It’s also good to check the put to call ratios for SPY, which tracks the S & P 500, for a rough comparison. That will give you an indication of what investors are expecting for the market as a whole. Note that options all have different strike prices, so you will want to check the put to call ratios for different strike prices.

Futures and after hours trading

You can look at futures and after-hours trading to see how a stock is moving as a leading indicator, that might help you decide when to enter or exit a position. For futures, S & P 500 and other index futures can indicate the overall direction of the market. For individual stocks you might look at after hours trading especially after a late earnings report. This can help you determine when to enter your next trade.

Fundamental Analysis for Forex

Fundamental analysis can also play an important role for Forex traders, especially if you are holding your positions for longer periods. The types of fundamental analysis you are going to use will primarily revolve around macroeconomic factors, political factors, and trade. You are going to want to keep a close eye on GDP growth, jobs and unemployment, and trade issues that can impact currencies. Political factors at home and abroad can also weaken or strengthen a currency. As we stated in the introductory remarks for the chapter, the strength of any given currency can’t be decided in isolation. Rather, you need to look for relative comparisons. You’ll also want to study past relationships between currencies to understand how they have changed historically in response to changing circumstances. The U.S. economy always looms large, but Japan and Europe are important too.